Subject: Request for Completion of Form W-9

Dear [Vendor's Name],

I hope this message finds you well. We are currently updating our records in compliance with IRS requirements and need your assistance.

As part of our annual reporting obligations, we must file a report with the IRS detailing all payments made to our vendors. This report requires your Taxpayer Identification Number (TIN), which is collected via Form W-9.

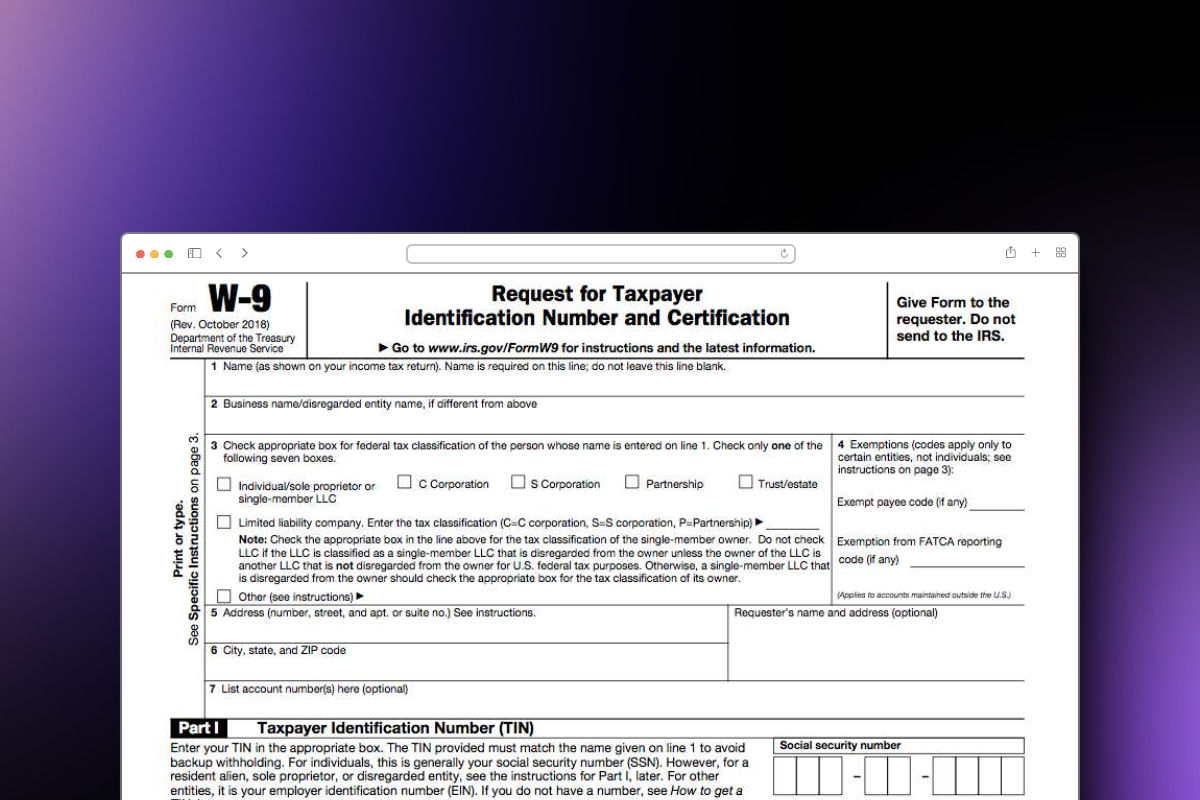

Please find the attached Form W-9, Request for Taxpayer Identification Number and Certification. We kindly request that you fill out and return this form at your earliest convenience. You can simply return it in the provided self-addressed envelope.

On the form, please also specify your business type in Part II. This information is crucial for us to report our transactions with your company accurately.

It's important to note that not completing Form W-9 can result in a $50 penalty. Additionally, without this information, we may have to withhold 29% of future payments and remit this to the IRS.

We appreciate your prompt attention to this matter. If you have any questions or need further clarification, feel free to reach out to me at [Your Contact Information].

Thank you for your cooperation.

Best regards,

[Your Name] [Your Position] [Your Contact Information]